Financial Data Q&A (Earnings Information)

Earnings Information

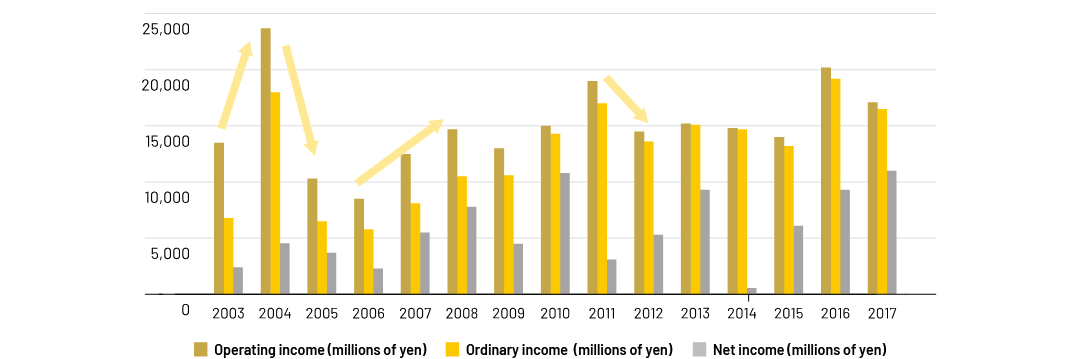

Why did earnings increase so much between 2002 and 2004?

- The Sapporo Group switched to a pure holding company framework in 2003 with four operating companies. Each of the operating companies had a new start with two goals. First was to increase earnings by managing operations with autonomy and speed. Second was to capture synergies with other group companies.

- In 2004, Sapporo’s Draft One was very successful. This pioneering product created a new alcoholic beverage category that is not beer or happoshu (low-malt beer). Sales totaled more than 18 million cases. This was the largest contributor to the upturn in earnings. In addition, there were big increases in operating income from beverages and restaurants. Earnings also benefited from measures to streamline operations, including the realignment of production facilities for alcoholic beverages. The result was substantial growth in operating income in 2004.

- Sapporo sold its hotel business, which operates the Westin Hotel Tokyo, in 2004. Proceeds from the sale were used to repay debt, which produced an improvement in net interest expenses that raised ordinary income to an all-time high.

- Furthermore, Sapporo began using the accounting standard for asset impairment earlier than the requirement for the purpose of improving its financial soundness. Although this resulted in asset impairment charges and losses on sales of property and equipment, Sapporo was able to offset these losses with its strong earnings, including the gain on the sale of the hotel business.

Why did earnings drop so quickly in 2005 after the big increase in 2004?

- The new market created by Draft One became even larger in 2005 due to the emergence of several competitors. But sales of beer and happoshu continued to decline. As a result, total demand in this product sector in 2005 was less than in 2004. Furthermore, the polarization of consumption, diversifying preferences and other trends created new challenges. In this environment, only companies with comprehensive strengths could succeed. To compete, companies required the expertise to develop products and services like Draft One that accurately target customers’ needs, to use these products to establish new brands, to be cost competitive, and succeed in other ways.

- In this difficult environment, the Sapporo Group’s operating income decreased mainly because of a decline in the alcoholic beverage profit margin caused by up-front investments in sales promotion activities to respond to new products of competitors.

- Although debt was reduced to improve net interest expenses, the decline in operating income caused ordinary income and net income to decrease, too.

Was the recovery in earnings in 2007 and 2008 due to any particular initiatives?

- In 2005, the Sapporo Group started its new medium-term management plan one year ahead of schedule. The plan was started prior to the end of the preceding management plan, which was centered on management reforms and building a new business model. The goals of the new plan, with 2006 as the starting point, were to speed up profit structure reforms and establish a base capable of sustaining growth. In October 2007, a long-term management plan called the Sapporo Group’s New Management Framework was announced. The primary objective is “the creation of High-value-Added Products and Services” by making even greater use of the Sapporo Group’s brands, assets and other strengths.

- Measures by the entire group to achieve the goals of this plan resulted in many accomplishments. In 2007, earnings improved for the high-end Yebisu brand of beer in Japan; in the international alcoholic beverages business, as the overseas strategy was strengthened mainly in North America, including the addition of SLEEMAN BREWERIES Ltd. to the group; and in the restaurant and real estate businesses. In 2008, earnings improved in the Japanese alcoholic beverages business and real estate business. The efficient use of sales promotion expenses, cost-cutting measures and price revisions for beer products in April 2008 further contributed to the increase in operating income in 2008.

- Along with the growth in operating income, ordinary income increased steadily as net interest expenses improved. Furthermore, there was a large increase in net income, which reflected growth in operating income as well as the gain on the sale of the 15% co-ownership stake in Yebisu Garden Place.

Changes in accounting and tax systems were responsible for the 2009 decrease in operating income. But why did net income decrease?

- Operating income was lower in 2009 because of higher operating expenses caused by changes in accounting and tax systems. After excluding the effects of these changes, operating income increased.

- Net income decreased in 2009 because net income in 2008 included the gain on the sale of the 15% co-ownership stake in Yebisu Garden Place.

Operating income and ordinary income have increased steadily between 2009 and 2011.

Only net income was down sharply in 2011. What are the causes of these changes in earnings?

- The Sapporo Group has been posting solid earnings growth since 2006, after excluding the effect of one-time items in 2009.

- In addition, the soundness of the profit structure has improved because of measures taken up to 2009 reform the cost structure. As a result, the group shifted its management stance to a new growth phase in 2010. For the alcoholic beverages business in Japan, the group adopted an aggressive posture based on a tight focus on carefully selected activities by concentrating on three core products: Sapporo Draft Beer Black Label, YEBISU and Mugi to Hop. All businesses contributed to growth in operating income, including a return to profitability in the restaurant business and higher earnings in the real estate business.

- Ordinary income also continued to increase in 2010. Higher operating income was one reason. Growth in ordinary income was also attributable to an improvement in net interest expenses, higher equity-method income due to the strategic alliance with POKKA CORPORATION, and other items.

- There was a big increase in net income in 2010 because of higher extraordinary income resulting from the sale of the site of the Osaka Brewery, which is part of measures to generate cash.

- There was a big decrease in net income in 2011 because of a loss resulting from the application of an accounting standard for asset retirement obligations, an extraordinary loss for disaster losses resulting from the Great East Japan Earthquake, and a decline in extraordinary income following the big increase in 2010.

In 2012, operating income and ordinary income decreased but net income was higher. What are the causes of these changes?

- We have positioned 2012 and 2013 as a period for starting to build a new group management framework for achieving rapid growth. There are three priorities: Challenge toward growth in all businesses; Carrying out growth measures; Creating new opportunities for growth. In 2012, there was growth in sales in the Japanese Alcoholic Beverage business and Restaurant business, the International Business segment, and the Food & Soft Drinks business.

- Operating income benefited from higher restaurant earnings as sales increased and, the inclusion of earnings from Yebisu Garden Place starting in March due to the purchase from the joint owners of 15% of the trust beneficiary rights for Yebisu Garden Place in the real estate business, and from other items. However, operating income was lower because of higher expenses for a number of reasons: expenses resulting from aggressive sales activities in the Japanese Alcoholic Beverage business and Food & Soft Drinks business; higher goodwill amortization in the Food & Soft Drinks business; the first quarter operating loss at the POKKA Group; and higher expenses for establishing a presence in Vietnam in the International Business segment.

- The decline in operating income caused ordinary income to decrease, too.

- Although ordinary income decreased, net income increased in part because of the loss in the previous year for the application of a new accounting standard and the decline in disaster losses.

Why was there such a dramatic drop in net income in 2014?

- There was a conflict of views with the national tax authority on the classification of “Goku Zero” for liquor law taxes.

We perceived “Goku Zero” as a product in the “Effervescent alcoholic beverage (1)” category. However, in the case in which “Goku Zero” did not fall under the “Effervescent alcoholic beverage (1)” category, this would cause much inconvenience for many customers and clients. Due to this, with the end of the sales of “Goku Zero”, we actively amended the application from “Sparkling Liquor (1)*” to “Basic taxation rate for effervescent alcoholic beverage”, which appropriated as a special loss of 11.6 billion yen (including overdue tax) in liquor taxes.*Liquor tax rate

Effervescent alcoholic beverage (1): 80,000yen /KL

Basic taxation rate for effervescent alcoholic beverage: 220,000 yen/KL - Some brewing methods were reviewed, and “Goku Zero” was relaunched on July 15, 2014, as “Happoshu – beer-type beverage with malt content less than 25%”.

What was the reason for the major rise in 2016 results?

- Reinforcements made on domestic and overseas brands were a success, resulting in an increase in sales and profit for all business categories.

Marketing for “Black Label” and “Yebisu” brands were enhanced for the domestic alcohol beverage operation, as part of the “Beer Reinforcement First Year” initiative. Many favorable results were also seen overseas, especially in Canada’s SLEEMAN BREWERIES, and business efficiency measures, such as improvements in manufacturing costs in the food and beverage business segment, were taken. The real estate category implemented measures to increase Yebisu Garden Place values and profitability, and completion of the “GINZA PLACE” also contributed to this result.

Why did the net income for 2017 increase, despite the fact that the operating income was going down?

- There were major changes in the market environment, such as decreased demand and higher material prices for orange juice in the U.S.A., and changes in tax regulations and restrictions in some Asian countries as well. The results for beverage operations in overseas countries were sluggish, causing a decrease in operating income. On the other hand, financial strategies to sell some real estate properties and shares held in cross-shareholdings were made to further streamline assets. These activities caused a growth in net profits during this period.

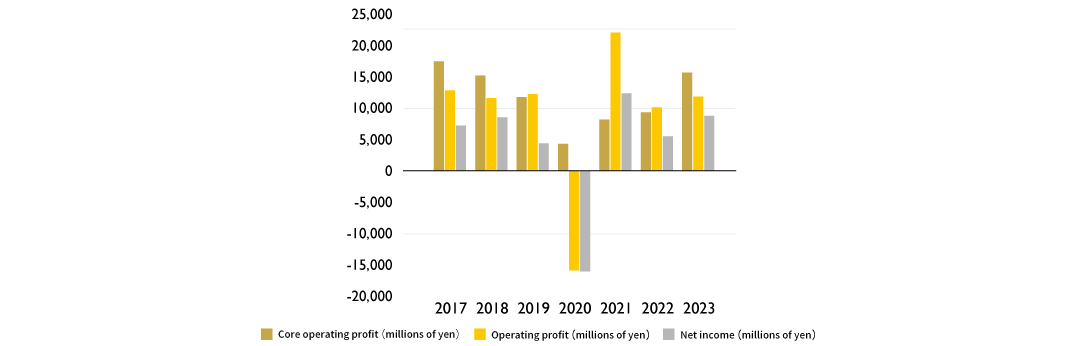

Why did revenue and operating income decline substantially in 2020?

- Revenue declined due to the substantial drop in sales of commercial-use beer and restaurants (Sapporo Lion) and beverages (Café de Crié coffee shops and vending machines) caused by the COVID-19 pandemic.

- The Food & Soft Drinks business booked impairment losses of 11 billion yen on property, plant and equipment in other operating expenses.

- One-off expenses of 4.9 billion yen were booked in other operating expenses, due to the implementation of an early retirement incentive program.

Why did earnings rise in 2021?

- Core operating profit increased from the previous year due to a curtailment in expenses from cost structure reforms.

- Operating profit and profit attributable to owners of parent were up year on year due to the sale of investment properties.

Why did Operating profit decerease by a large amount, despite revenue and Core operating profit increase in 2022?

- Revenue increased due to growth of overseas alcoholic beverages predominantly in North America, commercial-use market recovered, initiated price revisions in response to rising costs.

- Core operating profit increased due to the effects of increased revenue and structural reforms of the Restaurants and Food & Soft Drinks businesses.

- Operating profit and profit attributable to owners of parent decreased due to the sale of real estate last year.

Why did the performance in 2023 improve ?

- Increased core operating profit due to increased revenue in the Japan alcoholic beverages business and the effect of structural reforms on the restaurant business and Japan food & soft drinks business

- Despite recording an impairment loss of approximately 6.8 billion yen due to the resolution to dissolve ANCHOR BREWING COMPANY, LLC, this was offset by the increased core operating profit and review of held assets, etc.

Balance Sheet Information

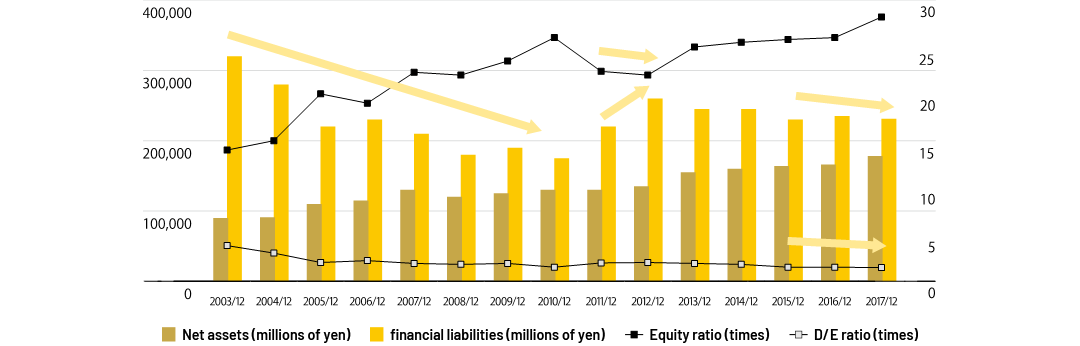

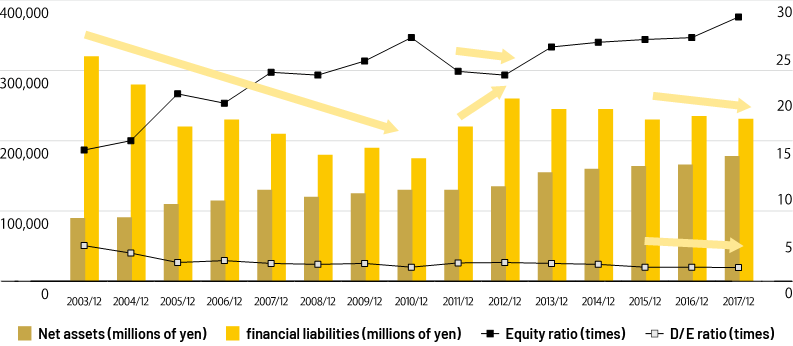

Between 2004 and 2010, why was the Sapporo Group able to reduce debt while improving the debt/equity ratio?

- The Sapporo Group switched to the pure holding company structure in 2003. The first three years after this switch were positioned as a period of rebirth. Priority was placed on reducing debt and the three-year target was achieved after only two years. The goals of the next plan, starting in 2006, were to move quickly to enact structural reforms and improve profitability as well as to maintain the proper balance between strengthening strategic investments and maintaining financial soundness.

- Strategic initiatives based on this plan produced more improvements in financial soundness. The result is a virtuous cycle that allows operating in a manner that leads to long-term growth. The group’s earnings increase, debt decreases, net assets increase along with growth in retained earnings, and investments can be made to generate growth in the future. Between 2002 and 2010, debt fell by more than half and the debt/equity ratio improved significantly from 3.4%to 1.4%.

Why did the equity ratio increase up to 2010?

- Total assets decreased because higher earnings made it possible to reduce debt. At the same time, growth in earnings caused retained earnings to climb. The result was an increase in the equity ratio. Between 2002 and 2010, financial soundness improved as the equity ratio increased from 14.8% to 25.3%.

Why did financial liabilities go up starting in 2010 and increased in 2011 and 2012 also causing the company's equity ratio to decline?

- Due to the improvement in financial soundness, the Sapporo Group was finally able to start implementing a growth strategy in 2010. As part of this strategy, we increased the pace of forming strategic alliances and growing outside Japan. In 2011, there was an additional purchase of stock associated with the management integration with POKKA CORPORATION, a purchase of stock associated with the purchase of a Sapporo Beverage convertible bond, and capital expenditures, mainly to construct the Long An Brewery of Sapporo Vietnam. Debt increased in 2011 to provide funds for strategic investments aimed at generating growth in the future.

- The year 2012 was established as a “period to build a new group management structure for rapid growth”. We acquired stakes for Silver Springs Citrus, Inc. and M's Beverage Co., Ltd., along with acquiring 15% of trust beneficiary rights to the Yebisu Garden Place for 100% equity. We have been actively investing for the future, continuing on from 2011, resulting in larger financial liabilities.

After 2013, the equity/asset ratio and the debt/equity ratio have been improving. What is the backdrop for this?

- POKKA SAPPORO Food & Beverage LTD. started off as an integrated company in 2013, to create our foundation towards becoming a “Food Manufacturer”.

- From 2014 to 2016, the Group focused on priority issues and implemented strategic investments in each field, while reducing costs across the group, aiming for sustainable growth as a “Food Manufacturer”. We attempted to optimize investments while aiming for the financial goal of 1.0 times debt/equity ratio, to reduce financial liabilities.

- In November 2016, we formulated“SPEED150”, a long-term management vision up to fiscal year 2026, the 150th anniversary of our founding, that represents our ideal state as a corporation. The “First Medium-term Management Plan 2020” for the first four years was also launched. This plan progresses with reducing financial liabilities while continuing with the 1.0 times debt-to-equity, by improved investment effectiveness and generating cash income with existing businesses, while actively apportioning to the core growing categories of ‘Alcoholic Beverages’, ‘Food’ and ‘Soft Drinks’. In 2017, we acquired all shares of Anchor Brewing Company to establish foundations for future development in the North America beer operation. Meanwhile, we have reduced our financial liability and increased capital through a rise in profit attributable to owners of parent. This was a result of streamlining assets, such as reviewing investment securities.

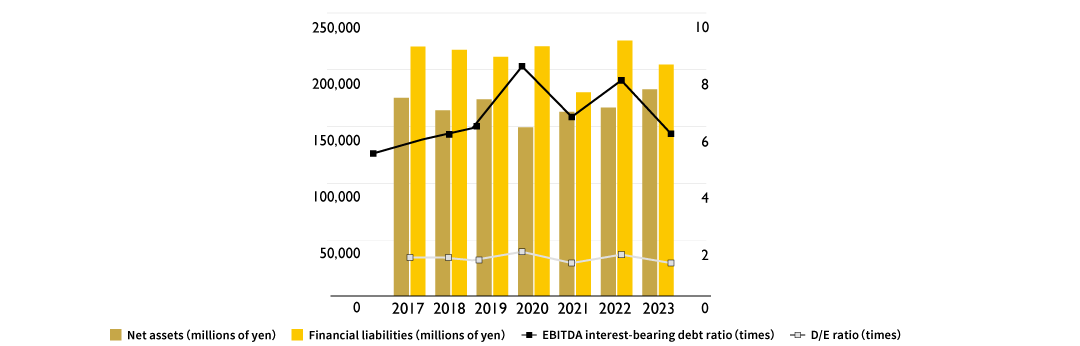

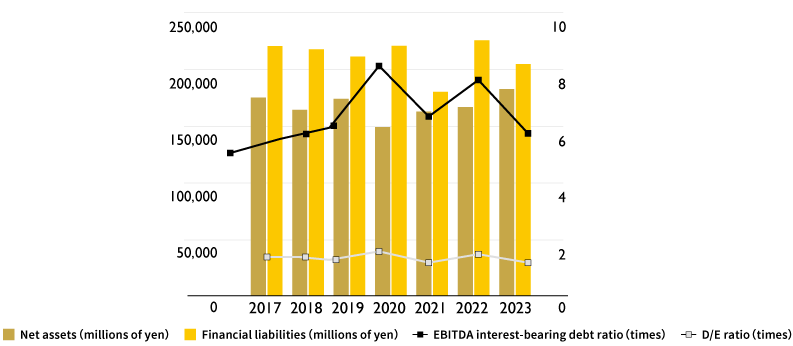

Why did capital decrease by a large amount in 2020?

- Capital decreased because of the substantial loss attributable to owners of parent caused by decreased revenue from the impacts of COVID-19 as well as the booking of impairment losses on property, plant and equipment in the Food & Soft Drinks business and implementation of an early retirement incentive program.

Why did financial liabilities decrease by a large amount in 2021?

- Financial liabilities declined substantially from used the cash generated from the sale of real estate what were Ebisu First Square and other properties to repay debt.

Why did financial liabilities increase in 2022?

- Financial liabilities increased due to the funding relating the acquisition of shares in Stone Brewing Co., LLC.

The financial health has improved in 2023. What's the reason behind this?

- The increase in operating CF and a review of owned assets, such as the sale of cross-shareholdings , led to an increase in FCF. This, along with the repayment of financial liabilities, has improved the financial health index.