Basic Policy and Structure

Basic Governance Approach

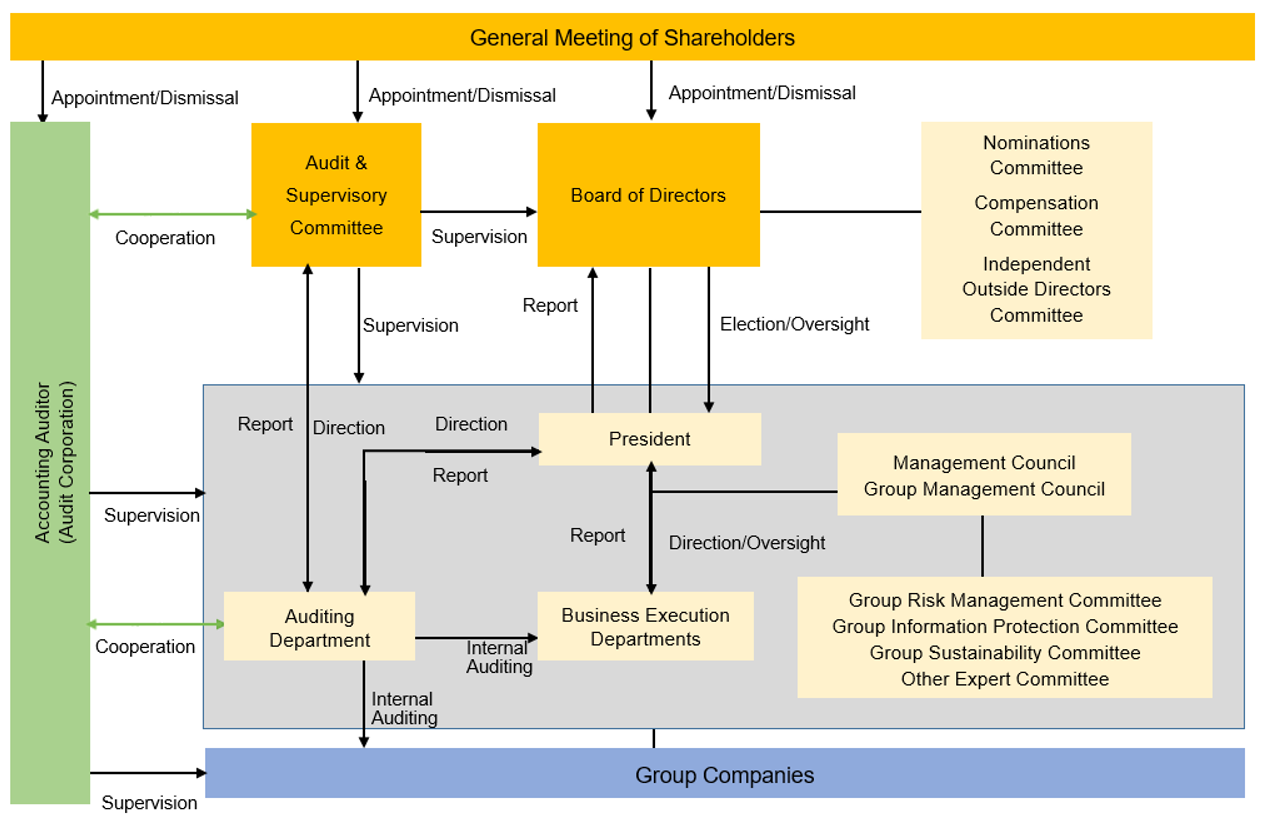

The Sapporo Group has enacted the Basic Policy on Corporate Governance for the purpose of specifying its thinking and operational policy regarding corporate governance with the goal of attaining sustained growth and enhanced corporate value over the medium to long term, and in light of the purport and spirit of the Corporate Governance Code set forth in the Listing Rules of the Tokyo Stock Exchange.

As part of the policy, the Group's basic philosophy is to regard strengthening and enhancing corporate governance as one of its top management priorities. The Group is working to clarify supervisory, business execution, and auditing functions throughout the Group under the holding company framework. The Group is also working to strengthen management supervisory functions to increase management transparency and achieve management goals.

Corporate Functions and Internal Control Relationships

*2 Group Sustainability Committee: Chaired by President & CEO

Board of Directors

The Board of Directors performs a supervisory role with regard to Group management.

It makes decisions on statutory matters and important matters related to business execution as stipulated by the Board’s regulations. The Board of Directors also elects and supervises the business execution of the representative director, president, Group operating officers.

【About Independent Outside Directors】

Seven of the eleven members of the company’s Board of Directors are independent outside directors. All of them have submitted notification to the Tokyo Stock Exchange and the Sapporo Securities Exchange of their independent director status, as stipulated by the exchange regulations. The independent outside directors are expected to objectively advise and supervise the management team from a neutral standpoint.

At the 14 meetings of the Board of Directors held in 2024, the independent outside directors gave advice and suggestions regarding various issues that were discussed from an objective viewpoint which was independent from that of the management.

Nominating and Compensation Committees

Sapporo Holdings has established a Nominating Committee and a Compensation Committee with the goals of increasing transparency with respect to the nomination and remuneration of directors, and of preserving a sound management structure.

The Nominating Committee is comprised of a total of seven members: independent outside directors (excluding directors who are members of the Audit & Supervisory Committee), directors who are members of the Audit & Supervisory Committee, and the president and representative director (or the chair of the Board if the president is selected from among the Group executive officers). The chair of the Committee is selected from independent outside directors (excluding directors who are members of the Audit & Supervisory Committee).

The Compensation Committee is comprised of a total of six members: independent outside directors (excluding directors who are members of the Audit & Supervisory Committee), directors who are members of the Audit & Supervisory Committee, and the president and representative director (or the chair of the Board if the president is selected from among the Group executive officers). The chair of the Committee is selected from independent outside directors (excluding directors who are members of the Audit & Supervisory Committee).

In fiscal year 2024, the Nominating Committee was held 12 times with an attendance rate of 100%, and the Compensation Committee was held five times with a 100% attendance rate.

* The Committee consists of seven members, including all independent outside directors (excluding those who are members of the Audit Committee), all directors who are members of the Audit Committee, and the President (or the Chairman of the Board when the President is selected from among the Group Executive Officers).

Group Operating Officers

The president controls business execution across the entire Group based on the resolutions of the Board of Directors. The Group operating officers, under the direct authority of the president, control business execution in the main business segments.

Audit & Supervisory Board

Sapporo Holdings has adopted the Company with an Audit & Supervisory Committee System, which has the function of auditing and supervising the performance of duties by directors, to further enhance corporate governance by increasing management transparency and efficiency, and to further improve corporate value through strengthening the management oversight function to achieve management targets.

【About Independent Outside Directors】

Sapporo Holdings’ Audit & Supervisory Committee is comprised of three members (two independent outside directors who are Audit & Supervisory Committee members and one company director who is a full-time Audit & Supervisory Committee member). Each of the two independent outside directors who are Audit & Supervisory Committee members is an independent director as stipulated under the regulations of the Tokyo Stock Exchange and the Sapporo Securities Exchange, and is expected to audit the performance of duties by directors from an objective and neutral standpoint.

At the 14 meetings of the Board of Directors held in 2024, the independent outside directors, who are also Audit Committee members, made appropriate recommendations and advice from the perspective of the legality, appropriateness, and validity of deliberations and decision-making. At the 21 meetings of the Audit Committee, they actively exchanged opinions with other Audit Committee members and made comments as necessary for deliberation of proposals.

2024 Meetings Record of the Board of Directors and Committees

| Name | Position and responsibility in the Company | Board of directors | Audit and Supervisory Committee | Nominations committee | Compensation Committee | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Subject | Attendance | Attendance rate | Subject | Attendance | Attendance rate | Subject | Attendance | Attendance rate | Subject | Attendance | Attendance rate | |||

| Masaki Oga | President | in-house | 〇 | 14/14 | 100% | - | - | - | 〇 | 12/12 | 100% | 〇 | 5/5 | 100% |

| Yoshitada Matsude | Managing Director | in-house | 〇 | 14/14 | 100% | - | - | - | - | - | - | - | - | - |

| Masashi Sato | Board member | in-house | 〇 | 14/14 | 100% | - | - | - | - | - | - | - | - | - |

| Toru Miyaishi | Board member Chairman of the Audit Committee Full-time Audit Committee Member |

in-house | 〇 | 10/10 | 100% | 〇 | 12/12 | 100% | 〇 | 9/9 | 100% | 〇 | 4/4 | 100% |

| Tetsuya Shoji | Board member | Outside the company | 〇 | 14/14 | 100% | - | - | - | 〇 | 12/12 | 100% | 〇 | 1/1 | 100% |

| Toshihiro Uchiyama | Board member | Outside the company | 〇 | 14/14 | 100% | - | - | - | 〇 | 3/3 | 100% | 〇 | 5/5 | 100% |

| Makio Tanehashi | Board member | Outside the company | 〇 | 14/14 | 100% | - | - | - | 〇 | 12/12 | 100% | 〇 | 1/1 | 100% |

| Kotaro Okamura | Board member | Outside the company | 〇 | 10/10 | 100% | - | - | - | - | - | - | 〇 | 4/4 | 100% |

| Ryotaro Fujii | Board member | Outside the company | 〇 | 10/10 | 100% | - | - | - | 〇 | 9/9 | 100% | - | - | - |

| Kotaro Yamamoto | Board member Audit and Supervisory Board Member |

Outside the company | 〇 | 14/14 | 100% | 〇 | 21/21 | 100% | 〇 | 12/12 | 100% | 〇 | 5/5 | 100% |

| Naoko Tanouchi | Board member Audit and Supervisory Board Member |

Outside the company | 〇 | 10/10 | 100% | 〇 | 11/12 | 92% | 〇 | 9/9 | 100% | 〇 | 4/4 | 100% |

| Total | 14 times | 21 times | 12 times | 5 times | ||||||||||

This table can be viewed in its entirety by scrolling to the right.

Standards and Policies Regarding the Independence of Outside Directors

Sapporo Holdings’ Nominating Committee requires that candidates for outside director meet the company’s Standards for Independence for Outside Directors. They are also required to have a strong background, track record, and insight into corporate management or certain specialist fields that will enable them to offer accurate proposals and advice on the company’s management issues. Candidates for Outside Audit & Supervisory Board member are required to meet the company’s Standards for Independence for Outside Directors. For the Standards for Independence for Outside Directors, see the Appendix - Basic Policy on Corporate Governance.

Compensation for Directors

The amount of individual remuneration for each director (excluding directors who are members of the Audit Committee) is determined by the Compensation Committee based on a resolution of the Board of Directors.

The amount of remuneration for each director who is a member of the Audit Committee is determined within the maximum amount of remuneration resolved at the General Meeting of Shareholders and in accordance with the criteria determined by the Audit Committee.

At the Board of Directors meeting held on February 14, 2024, a policy on the determination of the details of compensation, etc., for each director (hereinafter referred to as the "Policy for Determining the Details of Compensation, etc. for Directors") was resolved. A summary of the policy on the determination of details of compensation is as follows.

1. Basic Policy

- The remuneration of the Company's Directors (excluding Directors who are members of the Audit and Supervisory Board, and the same shall apply hereinafter) shall be a combination of cash and stock-based remuneration, and shall be linked to the Company's business performance and medium- to long-term corporate value, with the aim of contributing to the sustainable growth of the Company. The Company's basic policy is to set the remuneration of individual Directors at an appropriate level in consideration of their respective responsibilities.

- Remuneration for executive directors shall consist of cash remuneration and remuneration in the form of the Company's stock.

- Monetary remuneration shall consist of (1) basic remuneration (fixed remuneration) and (2) performance-linked remuneration, within the limit of the maximum amount of remuneration resolved at the General Meeting of Shareholders.

- The company's stock-based remuneration shall be composed of performance-linked stock-based remuneration as a base.

- Outside directors shall be paid only the basic remuneration.

2. Basic Remuneration

The basic remuneration for the Company's Directors shall be a fixed monthly amount in cash. The amount of the basic remuneration shall be determined by taking into consideration the position, the world standard, and the Company's business performance, as well as other factors, in a comprehensive manner.

3. Performance-linked Remuneration

Performance-based bonuses are monetary incentives based on the previous year's job performance. The amount is calculated based on the achievement level in relation to the target values of ROE and EBITDA for each fiscal year, and it is paid out in a lump sum every April, varying by position.

4. Share-based Compensation

The Company's stock-based compensation shall be performance-linked stock compensation. The stock-based compensation is in the form of performance-based stock options. In its calculation, points are awarded based on the achievement level of evaluation indicators that lead to the improvement of the medium to long-term corporate value (medium to long-term financial indicators, ESG indicators, employee engagement), as well as the evaluation of each director, and stocks of our company are granted according to the number of points awarded to each director after retirement. Details shall be stipulated in the Directors' Stock Benefit Regulations to be separately stipulated.

5. Percentage Ratio

The approximate ratio of basic remuneration, performance-linked remuneration, and treasury stock remuneration shall be 5:3:2 when the degree of achievement of performance targets is the highest.

6. Determination of Remuneration

Decisions on the details of individual remuneration, etc. of Directors shall be delegated to the Compensation Committee.

* Details regarding the Compensation Committee are as described above.

The compensation amounts for fiscal 2024 are outlined below.

| Classification | Total compensation amount (in millions of yen) |

Total amount of compensation by type (in million yen) | The number of targeted directors (persons) | ||

|---|---|---|---|---|---|

| Basic salary | Performance-based bonuses, etc. | Performance-based stock compensation | |||

| Directors (excluding Audit & Supervisory Board Members, including Outside Directors) | 218 (60) |

182 (+0) |

12 (-) |

24 (-) |

10 (6) |

| Director (Audit and Supervisory Committee Member, including Outside Director) | 53 (27) |

53 (27) |

- (-) |

- (-) |

5 (3) |

| Total (including outside officers) | 271 (87) |

235 (87) |

12 (-) |

24 (-) |

15 (9) |

Note:

1. The remuneration limit for directors (excluding directors who are Audit & Supervisory Committee members) was set to an annual amount of ¥500 million (within ¥100 million for outside directors, and excluding the employee part of those in employee-directorship positions) in accordance with a resolution of the 100th Ordinary General Meeting of Shareholders held on March 28, 2024.

The limit for directors who are Audit & Supervisory Committee members was set to ¥84 million in accordance with a resolution of the 96th Ordinary General Meeting of Shareholders held on March 27, 2020.

2. In addition to the abovementioned payment amounts, Sapporo Holdings has introduced a performance-linked, stock-based compensation system (Board Benefit Trust, or BBT) for directors (excluding outside directors), and contributed ¥446 million (over three business years) in accordance with the officer stock benefit rules stipulated by the system. The system is separate from the abovementioned directors compensation, in accordance with a resolution of the 92nd Ordinary General Meeting of Shareholders held on March 30, 2016.

Remuneration system for Directors (variable remuneration) and evaluation indicators and 2024 results, etc.

| Classification | Indicators (Note 1) | Results, etc. | |

|---|---|---|---|

| Performance-based bonuses | Sales revenue (vs. Plan) | Degree of achievement of actual results compared to targets for the fiscal year | Result: 4.1% / Plan: 5.5% |

| Business Profit (vs. Plan) | Degree of achievement of actual results compared to targets for the fiscal year | Result: 44.0 billion yen / Plan: 40.7 billion yen | |

| Performance-based stock compensation | Medium- and long-term financial indicators | ROE Establish annual evaluation criteria against the target of the medium-term management plan (8%) and evaluate |

2024 result: 4.1% |

| ESG indicators | 1.FTSE Russel ESG Score(Note 2) 2.MSCI ESG Rating(Note 2) 3. Greenhouse gas emission reductions (Scope 1, 2) Establish annual evaluation criteria of scores and ratings in each indicator |

2024 result 1. 3.3 2. AA 3. Assessed based on March 2025 preliminary figures (2024 target = 10.5% or more reduction from 2022 level) |

|

| Employee engagement | Work engagement(Note 3) Establish annual evaluation criteria with deviation values based on external institutional surveys |

2024 result: A | |

| Individual evaluation | Performance demonstrated by each Director | Determined by the Compensation Committee based on evaluation indicators for each individual | |

Note:

1. The Company selected these indicators because it aims to contribute to its sustainable growth by making performance-based bonuses commensurate with the results of the performance of duties during each fiscal year, and performance-based stock compensation linked to the Company's medium- to long-term corporate value.

2. Scores and ratings by international external evaluation organizations that collect, analyze, and evaluate ESG-related information on companies

3. Status of employees having positive feelings about their work and being fulfilled

Internal Audits

Under instructions from the president and representative director or the Audit & Supervisory Committee, the Group Audit Department, an internal auditing organization independent of the executive chain of command, audits overall operations of the Company and its subsidiaries with regard to the status of compliance with laws and regulations, the articles of incorporation, and internal regulations. The audit reports are circulated to the president and representative director, Audit & Supervisory Committee, and relevant parties.

Upgrading the Internal Control System

To ensure thorough implementation of the basic policies decided by the Board of Directors and carry out ongoing development and strengthening of systems across the entire Group, the Board of Directors takes responsibility for appointing directors with specific responsibilities and promoting specific measures. Moreover, the Guidelines on the Construction of Internal Control Systems at Sapporo Group have been enacted to set out specific matters in relation to internal control systems at the Group, and these guidelines are used to confirm the level of progress being made in individual measures and to promote collaboration.

For details about the status of our company’s corporate governance, please refer to our annual securities report and the corporate governance report submitted to the Tokyo Stock Exchange and the Sapporo Securities Exchange.

Please see below for the status of our policy on dialogue with the capital market.

Please see below for details on the dialogue with investors and the cycle of feedback to management, etc.